Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Stax Payments Review and Pricing

Table of Contents

- Stax is equipment-agnostic, so you can use its processing software with many different POS systems.

- Stax offers subscription-based pricing based on annual transaction volume; it doesn't take a cut of your revenue.

- All subscribers, regardless of transaction volume, can access Stax’s features and optional add-ons.

- Stax doesn’t manufacture its own hardware, so you’ll need to purchase POS equipment from Stax or another vendor.

- Some optional features come with additional fees beyond the regular subscription cost.

- Next-day funding isn’t always available and may require an extra fee.

Looking for more options?

Check out The Best Credit Card Processors of 2026: Pricing and Hardware business.com recommends.

Stax allows businesses to use nearly any POS hardware they choose. Additionally, Stax has over 200 prebuilt integrations and works with thousands of other apps via Zapier to help merchants create a custom solution. We chose Stax as our best pick for integrations with other business software.

StaxEditor's Rating:

9 / 10

- Pricing and fees

- 9.4/10

- Customer service

- 9.2/10

- Third-party integrations

- 9.5/10

- Payment options

- 9.3/10

- Added POS tools

- 8.0/10

Why we chose Stax as the best credit card processor for integration

Stax prioritizes flexibility, unlike processors we’ve reviewed that prohibit payment processing on third-party POS system devices. Stax’s software works with third-party POS systems, and vendors can reprogram compatible existing terminals.

The processor offers more than 200 built-in integrations and connects with 7,000 other business apps via Zapier. Stax helps businesses streamline operations, reduce manual work and create a seamless payment experience for customers.

Stax doesn’t lock customers into a specific setup and helps businesses create a customized payment processing system. For those reasons, Stax is our choice for the best credit card processor for integration.

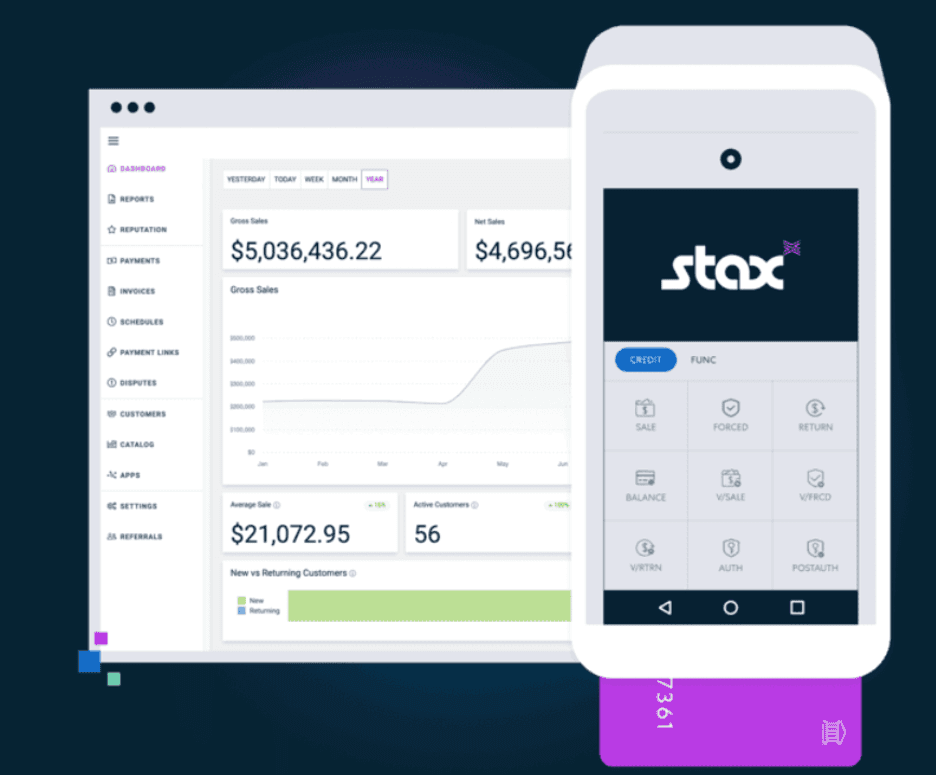

Stax offers a powerful payment processing platform with real-time analytics and mobile transaction capabilities. Source: Stax

Ease of use

During testing, we were pleased with the data analytics section that displays at-a-glance sales insights that owners of brick-and-mortar and e-commerce stores can use to gauge operational success and cash flow. You can view:

- Gross and net annual sales

- Month-over-month sales trends

- Average transaction value

- How many customers you’ve served

- How many transactions were processed over the past 30 days

- Data for multiple business locations

- Hourly sales activity to staff your business appropriately

- New vs. returning customers

- Calculates customer lifetime value for repeat customers

We appreciate the level of detailed reporting that’s found in the best POS systems.

The Stax dashboard provides key sales metrics at a glance, even for multiple locations. Source: Stax

Stax features

Here’s an overview of Stax’s key features that businesses of all sizes will find valuable:

Virtual terminal

Customers can access the virtual terminal through Stax’s dashboard on any computer, tablet or smartphone. Users can manually enter credit card details to accept payments over the phone. The virtual terminal allows you to invoice customers, schedule recurring payments, track inventory and issue receipts.

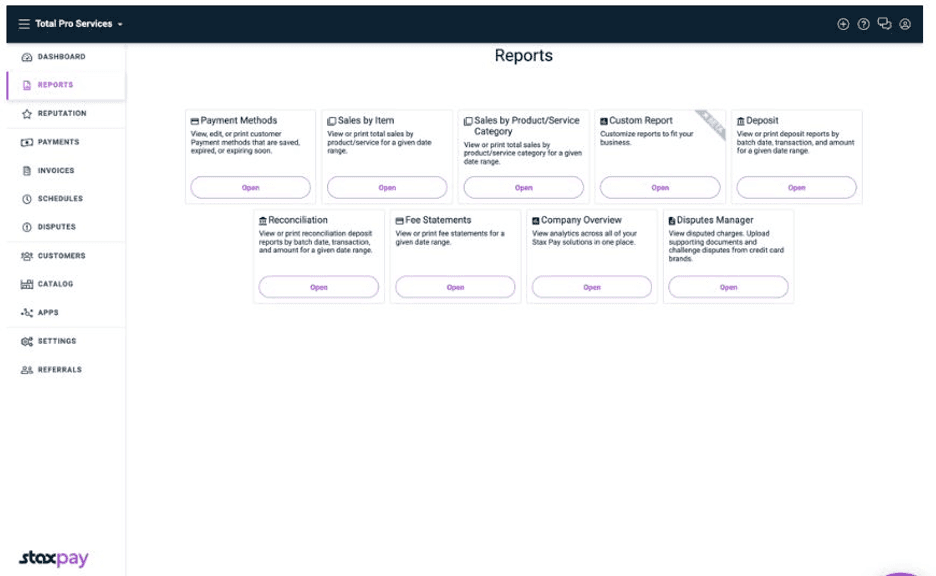

Reporting

Stax’s reporting features simplify the data analysis with details on a specified date range and view real-time reports. Similar to POS reports, you can access reports on payment methods, sales, item categories and more.

Stax’s reporting tools help owners track their business’s financial health. Source: Stax

E-commerce

We like that Stax can help you set up an online store with prebuilt templates for those without web-design experience. Tech-savvy users can work with Stax’s developer tools to build custom shopping carts to integrate into an existing online store. Stax also integrates with popular payment e-commerce platforms like BigCommerce, Magento, Shift4Shop, WooCommerce and Salesforce.

Integrations

Stax has built-in integrations with over 200 top business applications, so you don’t have to enter sales details into your other systems manually. It integrates with:

- Many of the best accounting software solutions, including QuickBooks Online

- Many of the best CRM software platforms, including Keap and Salesforce

- Top POS systems, including Revel Systems, ShopKeep and Vend

- Top e-commerce platforms, including BigCommerce, Shopify and WooCommerce

Stax offers a robust API for businesses that need a custom solution and can integrate with over 7,000 additional applications through Zapier.

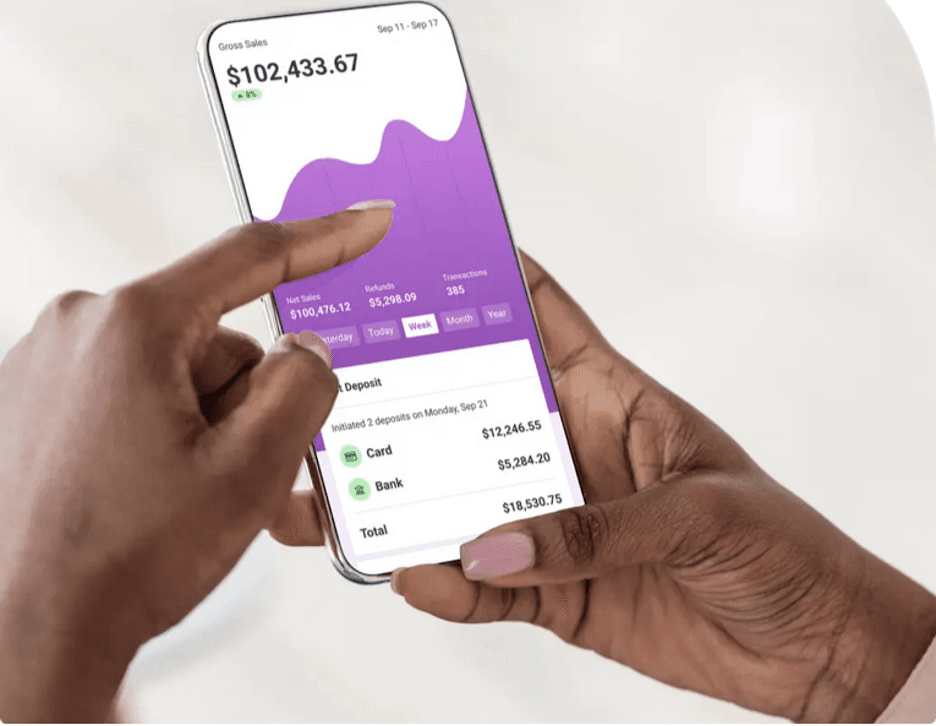

Mobile app

You can pair Stax Pay mobile app with a mobile reader to accept credit card payments on a mobile phone, creating an effective mobile POS system. The app allows you to manually enter card details, swipe or dip cards and send receipts and invoices to customers. You can accept tips, apply discounts and issue refunds.

All transaction information syncs with the Stax platform to review everything later in the browser version.

The Stax Pay mobile app lets you track activity, monitor cash flow and more. Source: Stax

Invoicing

You can create professional and customized invoices with drag-and-drop fields, memos and tax rates, and then send them via email or text to manage your cash flow. Set up recurring and scheduled invoices, and track payments at every stage to see when you’ve been paid and when an invoice is still pending.

Stax makes it easy to send customizable digital invoices. Source: Stax

Security

Stax’s equipment is PCI- and EMV-compliant, allowing you to accept chip cards securely and avoid liability for credit card fraud.

There’s no separate PCI compliance fee with Stax, but merchants must still comply with PCI data security standards and other credit card payment processing laws and rules. Businesses must submit a PCI compliance self-assessment questionnaire annually and possibly undergo quarterly vulnerability tests to maintain compliance.

Hardware

Stax’s credit card processing software works with various POS systems. Although Stax doesn’t manufacture its own hardware, it resells equipment from other vendors at what it claims is close to cost.

Stax-provided hardware options include Dejavoo, Verifone, Clover and SwipeSimple terminals. You’ll have to contact the company for pricing. If you already own compatible POS hardware, the company says it’ll reprogram existing terminals for free to work with its processing software.

Payouts

Stax payments are deposited into your business bank account within one to three days. Next-day funding isn’t guaranteed and requires an additional fee.

Stax pricing

Stax’s subscription-based pricing model is based on a business’s annual transaction volume.

Transaction volume | Starting price |

|---|---|

Up to $150,000 per year | $99 per month |

$150,000 to $250,000 per year | $139 per month |

Over $250,000 per year | Starting at $199 per month |

All subscriptions include access to:

- Dashboards and analytics

- Digital invoicing

- API key integration capabilities

- Text2Pay mobile payments

- Automatic updates for stored cards

- Recurring and scheduled payments

- Accounting reconciliation

- Hosted payment pages

- Payment links, buttons and QR codes

- Data exports

You can also opt for paid add-ons such as next-day funding, ACH payment processing and equipment and terminal protection. But the extra costs aren’t transparently listed on the Stax website to help businesses get a better idea of what they’ll ultimately pay.

Processing fees

When it comes to processing fees, many Stax competitors, including Stripe and PayPal, use an interchange-plus model, which means they charge the base card network fee plus an extra percentage on every sale.

Stax does it differently. It skips the extra percentage and just charges a small flat fee per transaction on top of the interchange (plus your monthly subscription). Here’s what you’ll pay:

- EMV credit card terminal: $0.08 per transaction above interchange

- Mobile credit card reader or online: $0.15 per transaction above interchange

Stax doesn’t take a cut of your revenue, unlike some competitors, like Clover and Square.

Implementation and onboarding

You should apply for a Stax account about two weeks before you plan to start accepting payments. We like that Stax’s application is online and takes about five minutes to complete.

You’ll need to provide basic information, including:

- Your business license

- Social Security number

- Tax ID

Once you’ve submitted these items, the company will review your application and set up your merchant account within two days. If you’re switching to Stax from another processor, you must submit a voided check and previous processing statements.

After approval, Stax ships your equipment (if purchased through the company), which arrives in four or five days. The equipment is plug-and-play, allowing you to start processing immediately.

We were impressed that Stax assigns each new merchant a dedicated account manager to help configure the account, software and hardware. This helps ensure your account, hardware and software are properly configured.

Customer support

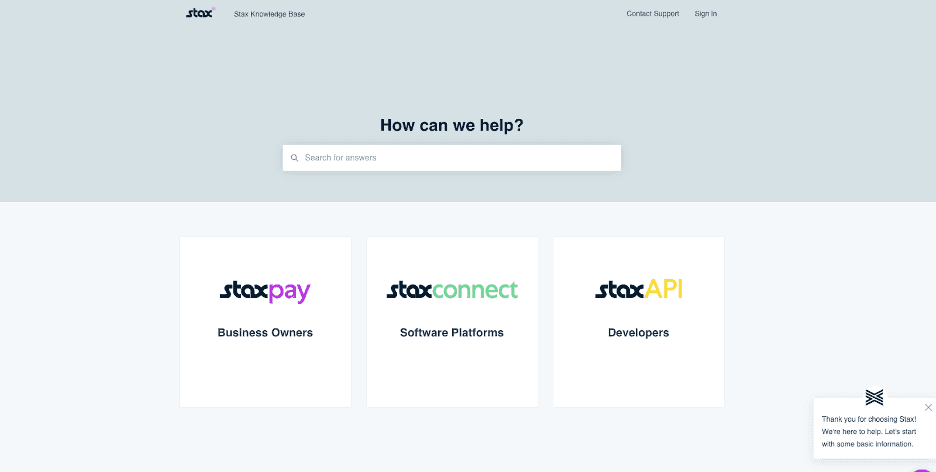

Businesses can contact Stax support via phone, live chat, email or via a help ticket form. You’ll have access to a payment consultant during the application process, and then a dedicated account manager to assist with configuration and onboarding.

We liked the company’s comprehensive online knowledge base, which provides articles and step-by-step instructions on product updates, chargebacks, PCI compliance, various software features, webinars and technical support issues.

The Stax online Knowledge Base is a great resource for customer self-help. Source: Stax

Limitations

Stax has a unique pricing structure and potentially low rates (if you’re a high-volume business), but it’s not the right payment processor for everyone.

- High costs: If your business has a low processing volume, Stax can be prohibitively expensive.

- No proprietary hardware: Stax’s compatibility with various POS systems is a plus unless you prefer a one-stop-shop solution with a proprietary hardware ecosystem (like Clover).

- Lack of pricing transparency: Stax doesn’t disclose hardware costs and potential fees.

- Next-day payouts are not guaranteed: Competitors offer guaranteed next-day payouts, but Stax requires an additional fee.

Methodology

We researched and analyzed many of the best credit card processors to help small businesses find a service that meets their unique needs. We also carefully examined user reviews and interactions with each vendor’s customer-service teams. We evaluated each company’s hardware and software offerings and how fair the contract terms are to merchants. We scrutinized and compared the rates and fees each processor charges.

To identify the best credit card processor for integration, we paid particular attention to equipment compatibility and third-party app integrations. To learn more about our methodology, see our full editorial process.

FAQs

Bottom Line

We recommend Stax for …

- Businesses seeking flexibility in their POS hardware.

- High-volume businesses that want to avoid credit card processors that take a cut of their revenue.

We don’t recommend Stax for …

- Businesses that need an all-in-one integrated POS and payment processing solution.

- Low-volume or budget-conscious businesses that struggle with the monthly subscription fees.

Looking for more options?

Check out The Best Credit Card Processors of 2026: Pricing and Hardware business.com recommends.